Introduction:

If you’re looking for the best way to save money and grow it safely, FintechZoom best CD rate could be your secret weapon. CDs (Certificates of Deposit) are like a treasure chest for savers—they let you lock in your money and earn high interest, all while keeping it secure. FintechZoom makes it super easy to find the top CD rates so you can make smart choices for your financial future.

Are you tired of low savings account returns? With FintechZoom best CD rate, you can compare CD offers from trusted banks and credit unions. This guide will show you how CDs work, why they’re great for saving, and how FintechZoom helps you find the best deals with just a few clicks.

FintechZoom Best CD Rate: Your Guide to Smart Savings in 2025

What Is a Certificate of Deposit, and Why Should You Care?

A Certificate of Deposit (CD) is a simple yet powerful savings tool offered by banks and credit unions. With a CD, you deposit your money for a set period and earn a fixed interest rate. The best part? Your money grows without the risks that come with stocks or other investments.

CDs are great for people who want a safe way to save and earn more than a regular savings account. They offer higher interest rates because your money stays in the account until the term ends. If you’re planning for big goals like a vacation, home improvement, or college savings, CDs can help you reach those milestones.

Why should you care about CDs? They’re insured by the FDIC or NCUA up to $250,000. That means your money is safe even if the bank fails. Plus, CDs come with flexible terms, so you can choose one that fits your needs—from six months to five years or more.

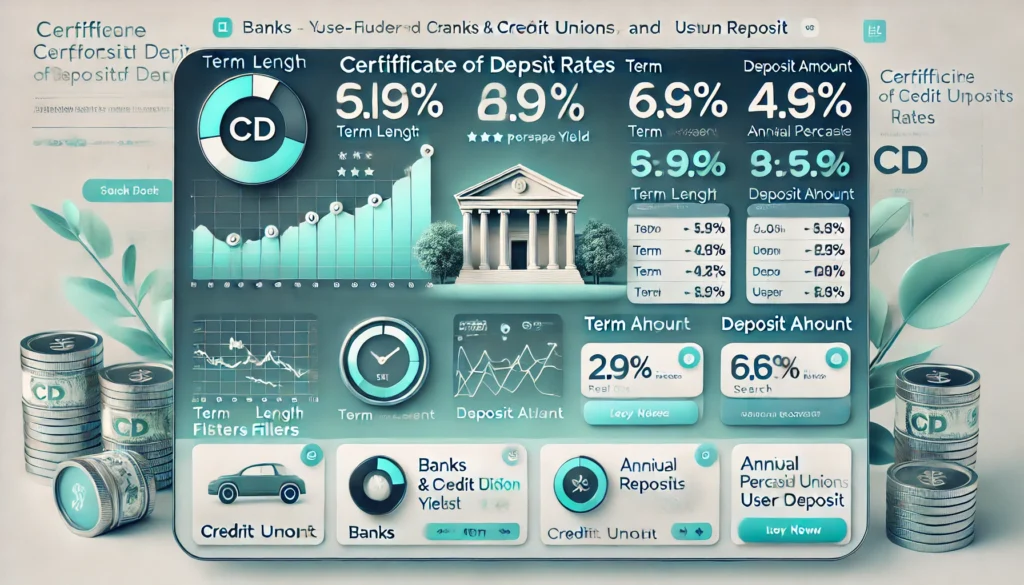

How FintechZoom Simplifies Finding the Best CD Rates

Finding the best CD rates can feel like searching for a needle in a haystack. That’s where FintechZoom best CD rate becomes a game-changer. It’s a platform that gathers and compares CD rates from different banks and credit unions, so you don’t have to.

FintechZoom makes it easy to see the latest and most competitive CD rates. Its real-time updates mean you’re always looking at accurate numbers. You can also filter results by term length, minimum deposit, and APY to find a CD that matches your savings goal.

What sets FintechZoom apart is its transparency. You’ll find all the details you need—like early withdrawal penalties, promotional offers, and special terms—so there are no surprises. It’s a one-stop shop for smart savers.

Top Benefits of Using FintechZoom for CD Research

Using FintechZoom to find the best CD rates comes with several benefits. Here are some highlights:

- Real-Time Updates: CD rates change often, but FintechZoom keeps its database fresh and accurate.

- Wide Coverage: Compare rates from big banks, local credit unions, and online-only banks in one place.

- User-Friendly Filters: Narrow down your search based on your preferred term, deposit amount, or APY.

FintechZoom also saves you time. Instead of hopping between websites, you’ll find everything you need in one easy-to-use platform. Plus, their customer reviews and expert insights make it easier to trust your choice.

FintechZoom Best CD Rate vs. Savings Accounts: What’s the Difference?

While savings accounts offer flexibility, CDs provide higher returns. With a savings account, you can deposit and withdraw money anytime. But a CD locks your money for a set term, rewarding you with a higher interest rate.

The FintechZoom best CD rate helps you find CDs that outshine most savings accounts in terms of APY. For example, a savings account might offer 0.5% APY, while a CD could give you 4% or more. The difference adds up over time.

However, CDs are less liquid. If you need your money before the term ends, you might face penalties. That’s why it’s essential to choose the right term and consider options like no-penalty CDs for added flexibility.

Step-by-Step Guide to Finding the Best CD Rates on FintechZoom

Finding the FintechZoom best CD rate is quick and easy. Follow these steps:

- Visit FintechZoom’s CD Rates Page: Start by going to the CD rates section of the website.

- Apply Filters: Use the search tools to select your preferred term length, deposit amount, and APY range.

- Compare Options: Review the list of CDs, paying close attention to APYs, penalties, and minimum deposits.

- Read Reviews: Check what other users and experts say about the financial institutions.

- Contact the Bank: Once you find a CD that fits, visit the bank’s website or call them to confirm details.

- Open Your CD: Complete the application process and start earning interest.

Short-Term vs. Long-Term CDs: Which One Is Right for You?

Choosing between short-term and long-term CDs depends on your goals. Short-term CDs, like six months to one year, are great if you want quick access to your money. They’re perfect for saving for short-term expenses or emergencies.

Long-term CDs, on the other hand, typically offer higher APYs. These are ideal for long-term goals, like retirement or college savings. However, your money stays locked in for longer, so make sure you won’t need it before the term ends.

If you’re unsure, consider splitting your investment across both short-term and long-term CDs. This way, you get the best of both worlds—higher returns and some flexibility.

CD Laddering: The Smart Way to Use FintechZoom Best CD Rate

What Is CD Laddering?

CD laddering is a strategy where you divide your investment into multiple CDs with staggered maturity dates. For example:

- Invest $2,000 in a 1-year CD

- Invest $2,000 in a 2-year CD

- Invest $2,000 in a 3-year CD

Benefits of CD Laddering

- Regular Access: Enjoy periodic liquidity as each CD matures.

- Higher Returns: Reinvest matured CDs into higher-rate options.

- Risk Management: Spread your savings across terms to reduce risks.

CD laddering works well when paired with FintechZoom’s tools to find the best rates for each term.

Conclusion: Why FintechZoom Is the Go-To Platform for CD Rates

FintechZoom is a trusted platform for finding the best CD rates. Its user-friendly interface, real-time updates, and wide coverage make it a favorite among savers. Whether you’re new to CDs or a seasoned investor, FintechZoom helps you make informed decisions.

With strategies like CD laddering and access to promotional offers, you can maximize your returns effortlessly. Start exploring FintechZoom today and take control of your financial future. Smart saving starts here!

Conclusion: Why FintechZoom Is the Best Choice for CD Rates

Finding the right CD to grow your savings doesn’t have to be hard. With FintechZoom best CD rate, you can easily compare the top offers from trusted banks and credit unions. It saves you time and shows you the best options to earn more interest on your money. Whether you want a short-term CD for quick goals or a long-term CD for future plans, FintechZoom helps you find exactly what you need.

The best part? FintechZoom is free to use and gives you real-time updates on rates, so you never miss a great deal. By following tips like CD laddering and choosing the right term length, you can make your savings work smarter for you. Start exploring FintechZoom best CD rate today and take the first step toward a secure financial future!

FAQs About FintechZoom Best CD Rate

Q: What is a CD, and how does it work?

A: A CD, or Certificate of Deposit, is a savings account where you deposit money for a fixed time to earn higher interest. Once the term ends, you get your money back with the earned interest.

Q: How does FintechZoom help find the best CD rates?

A: FintechZoom compares CD rates from banks and credit unions in real-time. It makes it easy to find the highest rates and terms that fit your savings goals.

Q: Is FintechZoom free to use?

A: Yes, FintechZoom is completely free. You can compare CD rates, explore options, and make decisions without any fees.

Q: Can I withdraw money from a CD early?

A: Yes, but most CDs charge a penalty for early withdrawal. To avoid this, consider no-penalty CDs if you think you might need your money before the term ends.

Q: How often are CD rates updated on FintechZoom?

A: CD rates on FintechZoom are updated frequently to ensure you always get the most accurate and competitive options available.

Q: Are online bank CDs better than traditional bank CDs?

A: Online banks often offer higher CD rates because they have lower costs. FintechZoom includes options from both online and traditional banks, so you can choose the best one for your needs.